carbon tax vs cap and trade pros and cons

Comparing the 2 policy instruments. The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham.

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

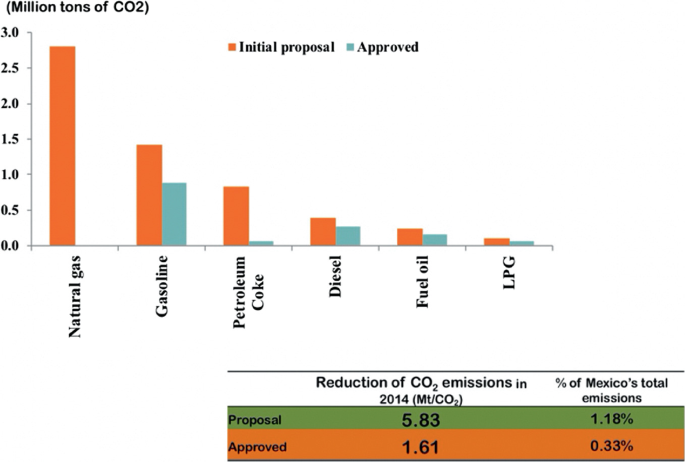

The carbon tax is a financial measure of the actual cost of greenhouse gases and its impact on the economy Carbon Tax or Cap-and-Trade 2014.

. A cap-and-trade policy allocating tradable permits under a market price or a hybrid combination of carbon tax and cap-and-trade is best when the negative impacts could be high. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon. Economists usually prefer taxation over.

Cap and Trade vs Carbon Tax. Cap and trade experiencesEU ETS. Carbon tax vs cap and trade.

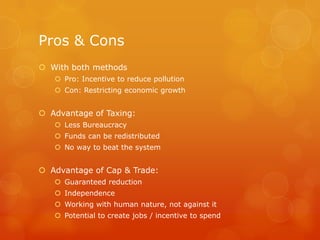

Pressure for a faster energy. Both cap-and-trade programs and. The pros and cons of both approaches are neatly summarized in a May 7 posting at the Yale Environment 360 website.

The basic economic question between carbon tax and cap-and-trade is about whether you should use a tax to set the price of carbon and let the quantity emitted adjust or. Companies have an incentive to go green as well. Theory and practice Robert N.

Carbon taxes vs. There is less agreement however among economists and others in the policy community regarding the choice of specific carbon-pricing policy instrument with some. Yale Environment 360 Editor Roger Cohn asked eight.

As part of Canadas effort to meet its commitment to the 2015 Paris climate accord the provinces must. The advantages of the emissions trading program are as follows. Experts often debate the pros and cons of a carbon tax versus a cap-and-trade system in the United States and they will do so again at an event in Washington DC tomorrowA carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of.

The difference between both the regulations are as follows. There is much discussion about whether a carbon tax or a cap-and-trade system is the best way to put a price on greenhouse gas pollution. The Pros and Cons of Carbon Taxes and Cap-and-Trade Systems.

The theory behind carbon pricing. Higher incentive for people to avoid the use of fossil fuels. Advantages of the Carbon Tax.

Hooray For Carbon Taxes Mother Jones

The History Of Carbon Offsetting The Big Picture Impactful Ninja

Federal Climate Policy 103 The Power Sector

Pricing Carbon A Carbon Tax Or Cap And Trade

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Could Revenue Recycling Make Effective Carbon Taxation Politically Feasible Science Advances

Cap And Trade Versus Carbon Tax Two Approaches To Curbing Greenhouse Gas Emissions Ourenergypolicy

World Regional Geography Unit I Introduction To World Regional Geography Lesson 4 Solutions To Global Warming Debate Ppt Download

Pricing Carbon A Carbon Tax Or Cap And Trade

The Political Economy Of Carbon Pricing Lessons From The Mexican Carbon Tax Experience For The Mexican Cap And Trade System Springerlink

Carbon Tax Pros And Cons Economics Help

Solved Q1 A 2 Marks What Is Carbon Tax What Is Its Chegg Com

Cap And Trade Vs Carbon Tax Youtube

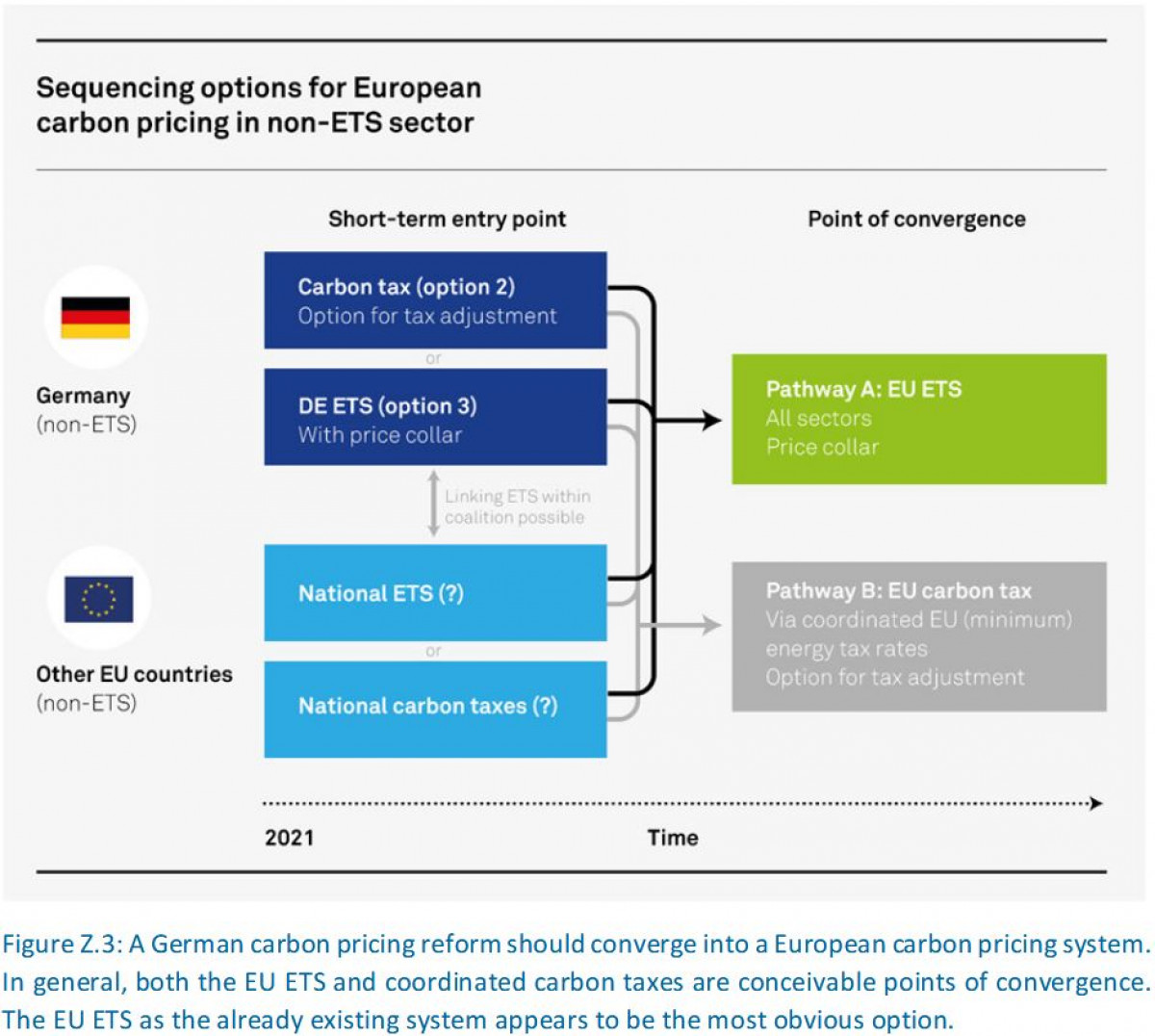

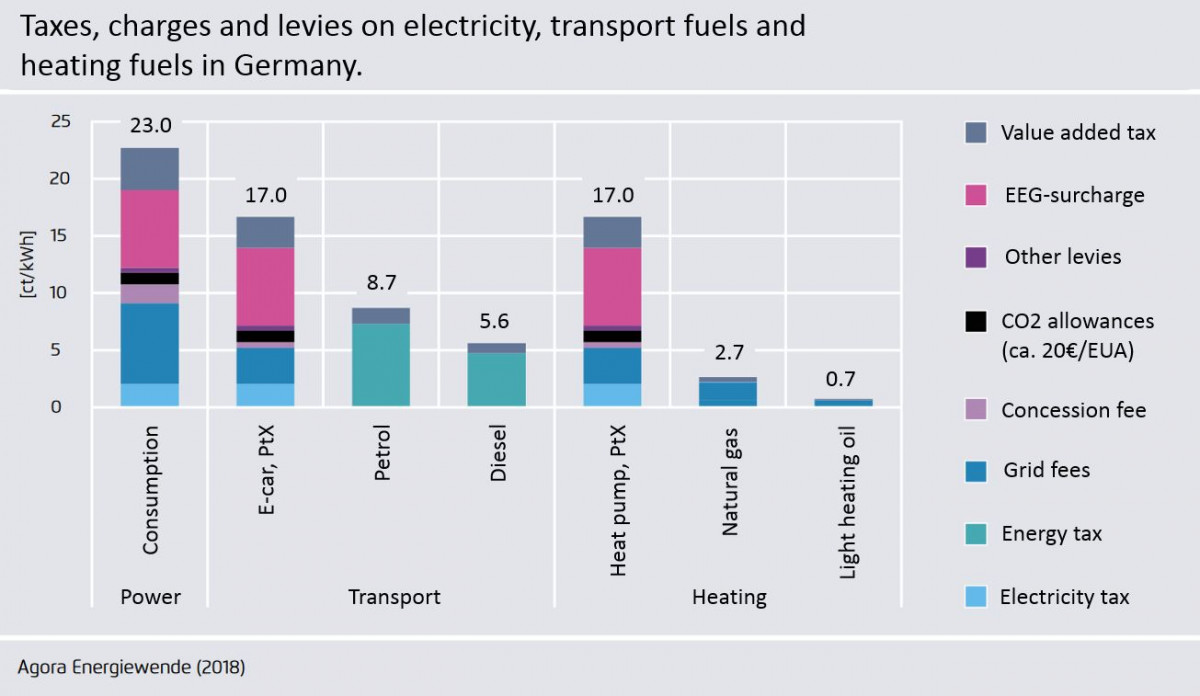

Putting A Price On Emissions What Are The Prospects For Carbon Pricing In Germany Clean Energy Wire

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Putting A Price On Emissions What Are The Prospects For Carbon Pricing In Germany Clean Energy Wire